Jobs Report Chases Rates Back Into the Range

For nearly two months, mortgage rates have been in limbo, stuck between the lower, more stable levels seen in March and the higher rates from earlier this year. With many market watchers waiting for clarity on trade policies, it’s been up to major economic reports to drive any big moves in rates.

The first week of each month brings a packed economic calendar. These reports typically take center stage:

ISM Manufacturing Index

ISM Services Index

Job Openings

ADP Employment

Employment Situation (the big jobs report)

The jobs report is always the most likely to cause big market swings. However, since it is released on Friday, the reports from earlier in the week often set the tone. Sometimes Friday’s jobs report adds to that momentum. Other times, it sends rates the opposite way — and this week was one of those times.

Midweek Momentum Toward Lower Rates

Of all the reports this week, Wednesday was the key turning point.

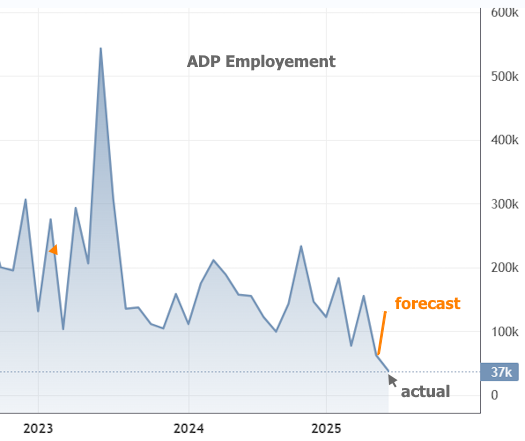

The day began with ADP Employment numbers coming in much weaker than expected — their lowest reading since January 2021.

That was the lowest reading for ADP since January 2021. Even though the month-to-month correlation between ADP and the payroll count in the jobs report is hit-or-miss, a large drop in ADP still gets the market's attention. After all, the two are still broadly correlated in the bigger picture:

The ISM data wasn't quite as much of a surprise by comparison, but it offered no objection to an economically gloomy conclusion. With that, bonds began moving as if Friday's jobs report would sing a similar tune. But if you noticed the "139k" on the chart above, you already know the chorus.

As has been the norm for most of the past few years, NFP (nonfarm payrolls, the headline job count of the big jobs report) came in above forecast. It wasn't a huge "beat," but really any beat would have been a surprise based on the setup informed by Wednesday's data.

The bond market was quick to react. 10yr yields (which are highly correlated with mortgage rate movement) shot sharply higher, easily erasing the gains seen 2 days before.

MND's mortgage rate index (average top-tier 30-year fixed scenarios) moved back toward 7% after hitting 6.87% on Wednesday. Note: This means that mortgage rates were actually higher this week. Survey-based rates from MBA and Freddie Mac were only able to capture weekly averages through mid-week, which was the best-case scenario this time around.

Bottom line: rates definitely were slightly lower on the week 2 days ago, but after the jobs report, they're back into the "almost 7%" range.

Next week brings several additional economic reports that traditionally matter to rates, but because those are focused on inflation, they'll be taken with a grain of salt until markets have more certainty on tariffs and trade deals. In addition to the data, the bond/rate market may cheer or protest certain developments on the spending bill being debated in the Senate.

Data provided by Hunt Mortgage